Irish Franchise Survey and Statistics 2006

- Foreword

- Introduction

- Key Facts

- International Comparisons

- Economic Impact

- Employment

- Turnover

- Origin

- Costs

- Initial Fees

- Initial Working Capital

- Total Investment

- Continuing fees

- Royalty Fees

- Advertising Levy

- Negotiation

- Territory

- Training

- Performance Clause

- Duration

- Conclusion

- Appendix 1: Case Study

Foreword

Continuing Growth

On behalf of The Irish Franchise Association, I would like to thank Franchise Direct for undertaking this year’s Irish Franchise Survey.

The strong economic growth and social changes we have seen over the past decade, where many families have both parents working outside the home, have increased demand for franchised products and services, resulting in the heightened interest in franchising as an option for people considering setting up their own business.

Since the first franchise was introduced into Ireland nearly 40 years ago, there are now more than 270 different franchises in operation employing in excess of 25,000 people in the sector.

The statistics in the survey are witness to the importance of franchising, and the growth is indicative of the buoyancy of the sector which presents tremendous opportunity for people wanting to start their own business, as there is still massive scope for new and different franchise systems to enter the Irish market, not to mention the potential for indigenous businesses to expand through the franchise route.

The outlook for franchising in Ireland looks very positive. Irish consumers are more brand aware and quality conscious, therefore a franchise with a strong brand identity and exceptional quality service should reap rewards.

This survey is an excellent reference point for anyone interested in starting a franchising business in Ireland.

John Green

Chairman

Irish franchise Association

Franchising in Ireland Survey 2006

The ‘Franchising in Ireland’ series of studies conducted regularly over the past 20 years charts the progress of an industry that was at first treated with scepticism by many people in the country. The perception was that it was mainly confined to the fast food sector and was a fad that would not survive. But in reality franchising encompasses virtually all services, from hotels, to coffee shops, residential cleaning, pet grooming, computer training and many more. The case study in Appendix 1 shows that franchising can provide not only optional goods and products but, in this case, vital services that complement and contribute to our stretched health care system.

For anyone seeking a franchise opportunity it has never been easier. A variety of dedicated franchise websites now provides immediate access to hundreds of different franchise systems. In the United States alone there are over 3,000 different franchises in operation, representing a significant engine of growth in the US economy.

Franchising is a major funder of US export earnings, as royalty payments from global franchises contribute significantly to the country’s service exports. This export success is matched by a commitment of resources by the US Department of Commerce to fostering and encouraging US franchises overseas. No other country, Ireland included, has given such support to its franchise sector, and the US remains the dominant player in this market.

Key facts and statistics about the franchise industry

- Growth in disposable income: A franchise business can only operate in an industry with reasonable margins, because of the split of income between franchisor and franchisee. Ireland now has one of the highest levels of income in the EU and is a very attractive location for franchises from all over the world.

- Growth of the service sector: Franchising is almost exclusively a service oriented business and as Ireland’s economy becomes increasingly dominated by services, franchise companies will benefit accordingly.

- Attractiveness of shopping centres: The brand recognition that is an inherent part of franchising is a very attractive proposition for a shopping centre owner or developer. A walk around any of Ireland’s shopping centers, which now account for an increasing volume and value of retail sales, illustrates the pervasive presence of the franchise industry.

- A dynamic engine: A franchise system is made up of entrepreneurs brought together through association with a common brand. This mix of entrepreneurs working individually, but complementing each other, is a dynamic and competitive force that cannot be matched by anyone building a business on their own.

- Constant change: One of the great drivers of economic activity is change, and no industry can adapt to change like franchising. In this survey we describe Home Instead Senior Care, a franchise that has evolved to target the increasing numbers of elderly people in our society who want to maintain their independence and live at home, but next year’s case study could be about sports or recreation franchising, or health and beauty, or indeed a new franchise that is tackling climate change.

International comparisons

The performance of franchising in the Irish market compares very favourably with the UK. According to the latest Nat West/BFA survey, franchising contributes £10.8 billion (€15.94b) in revenue to the UK economy, compared with a turnover of €2.099 billion in Ireland. The franchise industry in the UK employs 371,600 people, in contrast to 25,461 employed in the sector in Ireland.

Economic impact

The adaptability and flexibility of all the franchising sectors in Ireland has added to economic growth by attracting a wide range of entrepreneurs and investors. Franchising, the new business expansion strategy, provides potential franchisees with a wide range of opportunities in more than one hundred lines of business, business formats, financing programs and investment options. The past ten years has seen significant growth in franchising throughout the country, with the number of franchise systems doubling since 1997. There are currently 270 active systems in Ireland, representing a net increase of 34% since the 2004 survey. This figure compares to 759 systems in the UK.

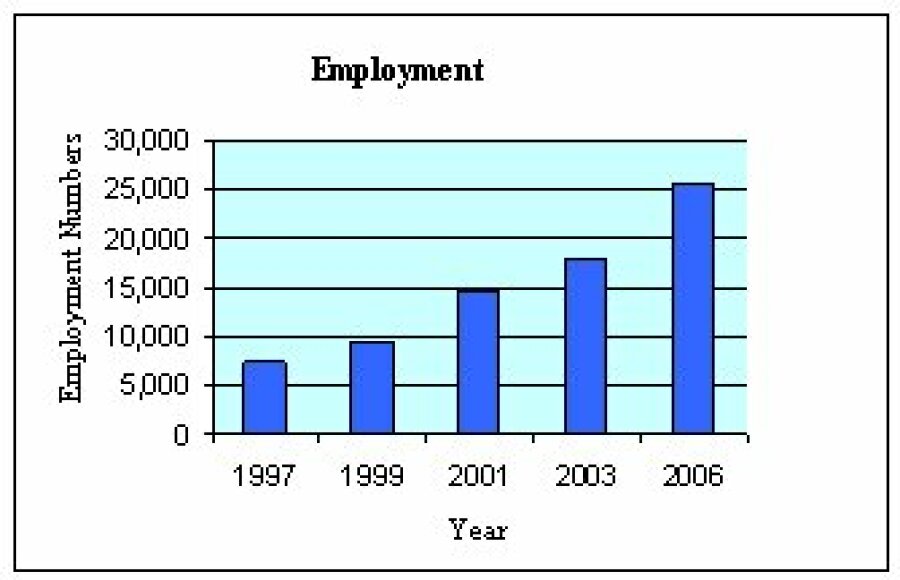

Employment in the franchise sector

| 1997 | 1999 | 2001 | 2003 | 2006 | |

| Employment | 7,400 | 9,600 | 14,400 | 17,890 | 25,461 |

| % Change | 51% | 30% | 50% | 24% | 42% |

It is estimated that franchise systems in Ireland provide 25,461 jobs. This consists of jobs directly created by franchises, but excludes the additional indirect but dependant jobs created by suppliers to the franchisors and franchisees.

This figure represents a 42% increase since the 2004 survey. The fact that the employment level has grown more than threefold in the last ten years shows that the franchise industry is a valuable contributor to the Irish economy.

Turnover

Turnover of Franchise Systems in Ireland (€bn)

| Turnover of Franchise Systems in Ireland (€bn) | |||||

| 1997 | 1999 | 2001 | 2003 | 2006 | |

| Turnover | 0.397 | 0.571 | 1.02 | 1.272 | 2.099 |

| % Change | 55% | 43% | 79% | 24% | 69% |

The turnover of the franchise systems operating in Ireland is estimated at €2.099 billion. This is a major increase of 69% since the previous study in 2004, and represents a five-fold increase in sales through franchised businesses in the past ten years, excluding the very significant turnover of the symbol groups.

Origin

Indigenous Irish franchises account for a small percentage of the franchise market, with only 14% of systems originating in the country. Nevertheless growth is evident; the percentage has risen from 11% in the 2004 survey. The USA remains the dominant player for franchise systems in Ireland, with 41% having originated there. The percentage of franchises from countries other than Ireland, the USA and the UK remains low at 9%.

| Country of Origin | % of Franchises | |

| USA | 41% | |

| UK | 36% | |

| Ireland | 14% | |

| Other | 9% |

Cost

In exchange for using the franchise brand name and receiving an established marketing network, operational guidance and support from the franchisor, franchisees must pay both upfront fees and ongoing fees. Details of these are set down in the Franchise Agreement. This is a legally binding contract that governs the responsibilities and expectations of the franchisor and the franchisee, including all payments and costs.

The predominant types of ongoing fees are royalties (management service fee), fixed annual fees and advertising fees. These vary greatly from franchise to franchise, due to the many different business models, franchisors and agreement terms. These ongoing fees can be defined in terms of a fixed amount or a percentage of sales.

| 2006 | 2003 | 2001 | 1999 | 1995 |

| Fee | Average | Average | Average | Average | Average |

| Initial fee | €24,663 | €22,200 | €21,000 | €14,000 | €11,881 |

| Initial working capital | €39,300 | €40,280 | €33,000 | €25,395 | €18,006 |

| Total investment cost | €226,000 | €222,000 | €160,000 | €89,000 | €81,545 |

| MSF/royalty fee | 6.5% | 7.4% | 7.1% | 6.5% | 7% |

| Advertising levy | 2.2% | 2.6% | 2% | 2.9% | 2.5% |

InitialFees

The initial start-up costs are the first step in acquiring a franchise, with over 90% of Irish franchises requiring an initial fee. For a single unit, this can vary from €2,500 to €125,000, compared with $2,000 to $300,000 in the USA. These payments act as compensation for the experience, training, recruiting, and the right to use the brand name of the franchise. Initial fees vary widely due to the different types of franchise sectors, the variability of fees within each sector, and different territory options chosen by each franchisor. The average initial fee in Ireland is €24,663, a small increase of 11% since 2004. For a multi-unit franchise this would be higher, as the master agreement grants the franchisee a larger territory and the opportunity to sub-franchise. Seventy six percent of franchises charge an initial fee of less than €30,000, and 8% charge no initial fee at all.

Initial working capital

Working capital requirements vary considerably in franchises in Ireland, ranging from €2,500 to €300,000. The initial working capital has been increasing gradually over the past number of years, but since 2004 has shown a 2% downturn to an average of €39,300. This fee remains low because of the faster start-up involved in franchising and good cash-flow in the early years.

Total investment

The increase in the average total investment in a franchise from €222,000 to €226,000 has not been significant. However, this figure is not a clear representation of the investment level for franchising, because of the differences in the financial requirements for franchises. The costs vary widely, from as little as €7,500 to as much as €7 million. The figure of €226,000 is an average and it is possible to find a franchise with much lower investment requirements. Over 60% of franchises operating in Ireland, for instance, request less than €100,000.

Continuing fees

These fees include the fixed annual fee, management service fee (MSF), royalty fee and the advertising levy. Eighty three percent of those surveyed pay the fees monthly to fund the continuous services provided by the franchisor. The majority of franchises (60%) operate the ongoing royalty and advertising fees. For the 22% of franchises that do charge a fixed fee, the average is €10,275 for franchises set up in Ireland, and can range from €1,500 to €24,500.

MSF/royalty fees

Most franchisors charge a royalty based on a percentage of the gross revenue of the franchise unit. This can be either a fixed percentage, percentage range or a sliding percentage scale. The Irish royalty fee is 6.5%, averaged around an even spread of 2.5% to 25%. This is in line with international standards, with the average in the USA being 6.7%.

Advertising levy

The advertising levy acts as a contribution towards the costs of building and sustaining the marketing network. When the franchisee enters into the franchise agreement, it is probable that the franchise already has a brand name in place, which will increase the chances of a steady cash flow over the start-up period. Compared to a 5% average levy in the USA, where advertising is highly credited in the market, Ireland has remained constant at an average levy of 2.2%. It can range from a low of 0.5% to a high of 5%.

Negotiation

Negotiations depend primarily on the qualities or resources the franchisee can bring to the partnership. Although only 8% of franchisors are willing to negotiate fees, if the franchisee has competitive advantages in regard to location or customers, the franchisor is inclined to be more flexible in these matters.

Territory

The area of territorial rights can be based on a number of factors such as population, geographical area, business potential or neighbouring franchisees. Although the demand for exclusive territorial rights is high, 23% of the franchisors surveyed do not grant exclusive territories. However, it is in the franchisors’ as well as the franchisees’ interest to grant a protected area to the franchisee in order to expand and develop the business. There is a decrease in the number offering exclusive territories, with the figure falling 30% since the 2004 survey.

Training

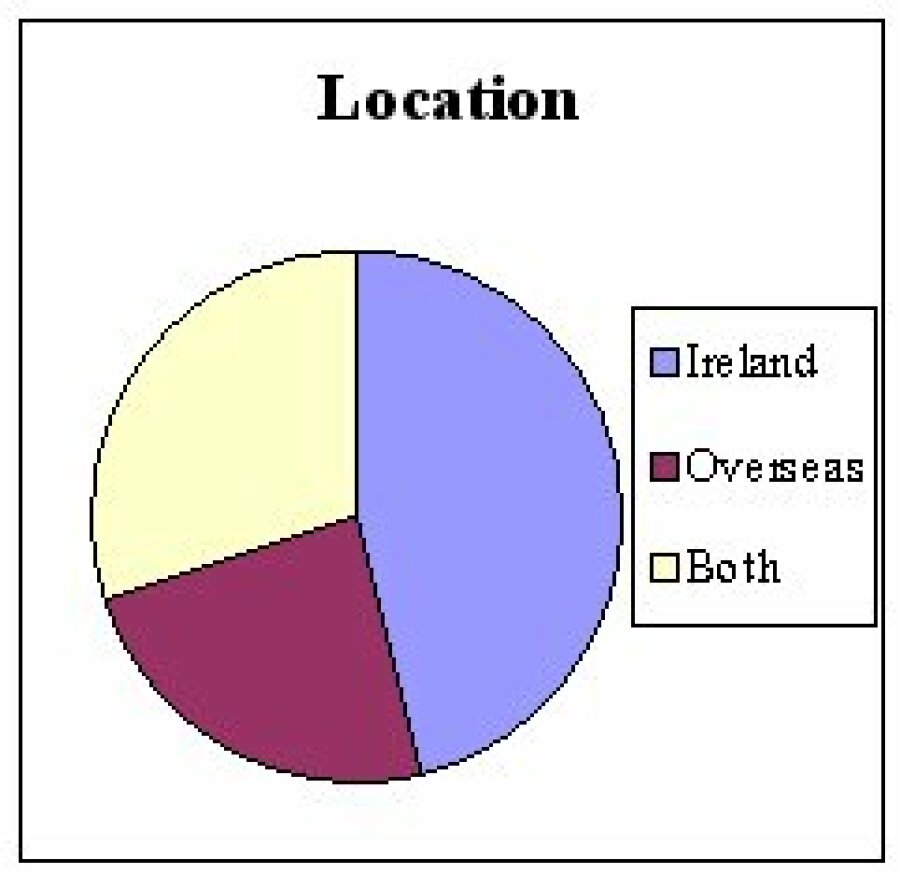

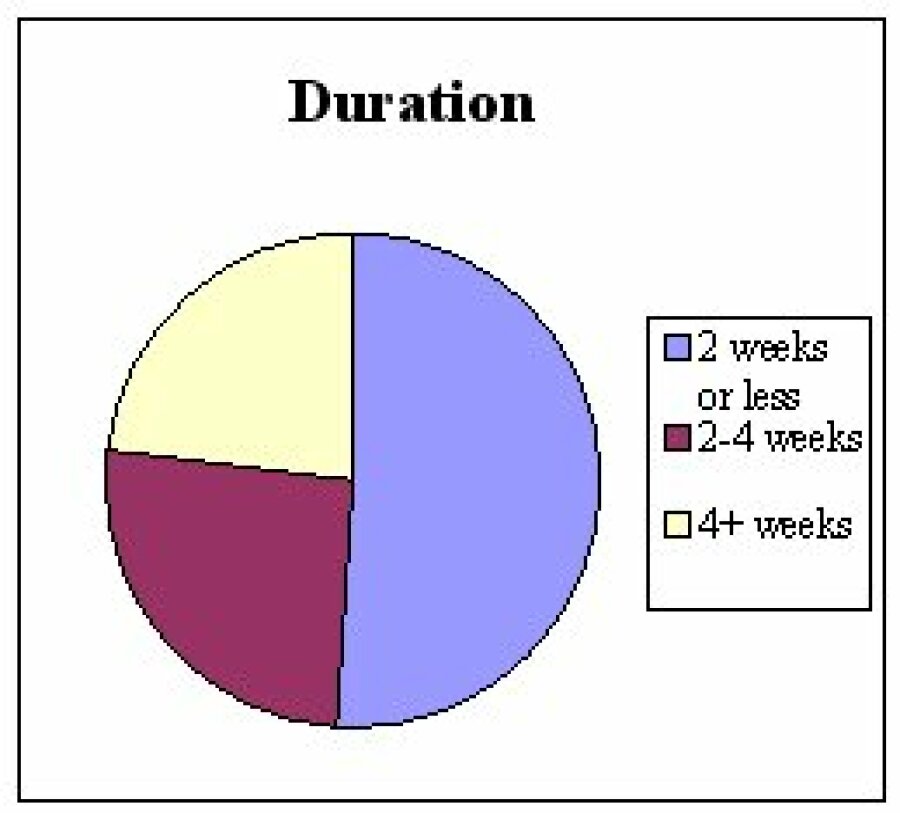

One of the many services a franchisee pays for in their investment is the knowledge, experience and training provided by the franchisor. The majority of franchisors provide training as an ongoing process, introducing the franchisee to new skills, products, methods and procedures. One hundred percent of franchisors provide initial training, with 77% of these offering a training program of less than one month’s duration. The location of the training is an important aspect for consideration. The table below shows that Ireland is still the primary base for training locations, with nearly half the franchisors providing training within the country.

|

|

| Ireland Overseas Both | 46% 24% 30% | 2 weeks or less 2 – 4 weeks 4 + weeks | 51% 26% 23% |

Performance clause

Performance clauses are the conditions and standards that must be met in the franchise agreement such as, in the case of a food retail franchise for example, food safety, hygiene, storage arrangements etc. Reports from this study show little change in the number of franchise agreements containing performance clauses, with 51% of franchises having them, compared to 56% in the 2004 survey.

Duration

The duration of the franchise agreement and the willingness to renew it are important if the franchisee is making a significant investment in a brand and franchise system. The franchisee needs the opportunity and the time to get a return on this investment. The duration of agreements is generally increasing, with 54% being for five years, and 35% being for ten years.

Conclusion

The findings of the 2006 survey demonstrate the vibrancy of the franchise industry in Ireland, and its capacity to generate jobs and wealth. Franchising is now a significant contributor to new business start-ups throughout the country. There is nothing to suggest that this upward trend won’t continue. On the contrary; franchising is making its mark around the world, as established brands, and some newcomers, expand further and further into international markets, creating a global brand awareness for themselves in the process. There is every reason to expect that Ireland will continue to be subject to the same penetration by franchise companies seeking new, lucrative locations for their products and services.

Appendix 1: Case Study

Home Instead Senior Care

Franchise Direct talks to Ed Murphy, Managing Director of the Master franchise for Home Instead Senior Care in Ireland

Origins

Home Instead Senior Care traces its origins to a single start-up in a USA office founded by Paul and Lori Hogan in 1994. It began franchising a year later in 1995. Since then it has grown to a network of over 700 independently owned and operated franchises in the United States, Canada and Western Europe.

Home Instead Senior Care enhances the quality of life for the elderly by providing part-time and full-time services for those who wish to remain in their homes but need assistance, supervision and/or companionship. Home Instead assists over 30,000 elderly people worldwide.

Background

Home Instead Senior Care was introduced to Ireland in 2005 by Michael Kearney and Ed Murphy, former director and managing director respectively of the Snap Printing master franchise in this country. Ed’s natural entrepreneurial talent and hard work earned him the Sam Bristow Memorial Award in 1999, which is given to people who have demonstrated business excellence. Their experience of managing the biggest printing company in Ireland for 13 years equipped the two with the perfect profile for the Home Instead Senior Care master franchise.

Why Home Instead?

Having already successfully operated a master franchise, Michael Kearney and Ed Murphy were in a position to expertly appraise the Home Instead Senior Care opportunity. With a strong interest in health care services and their potential for growth in the Irish market, Michael and Ed researched various options in the US before identifying Home Instead as their ideal franchise prospect. “I really liked the people and could see it was a serious business opportunity,” Ed explains. Home Instead Senior Care was the biggest player in the industry and the company’s professional image, combined with the need for similar services in Ireland, encouraged Michael and Ed to start negotiations for the master licence for the whole country.

Asked about his concerns regarding the adaptability of the franchise, Ed remarks wryly, “One always has concerns.” The considerable differences in the Irish and US health care systems were a potential problem, but the smooth transfer of the franchise from the US to Japan, and its subsequent success in that country, was a strong indicator that the model could work anywhere. Ed was confident that, with his and Michael’s experience of master franchising, they could make a go of Home Instead in Ireland.

The Start-up

On June 6th 2005, Michael Kearney and Ed Murphy launched Home Instead Senior Care with the opening of the first office in Leopardstown, Dublin. They and their team focused on developing the business in the beginning and did not begin to recruit franchisees until a year later. Home Instead Senior Care now operates eight offices around the country and plans to open four more by the end of 2007. The main office in Leopardstown clocked up the most successful first year ever recorded by a Home Instead office out of 700 operations worldwide. The following year they achieved this position for year two. The Leopardstown office is now in the world’s top five leading Home Instead offices in sales, only two years after start-up. In recognition of its success here, Home Instead Senior Care was awarded the ‘Best Emerging Franchise in Ireland’ by the Irish Franchise Association in 2006.

Success

Ed Murphy attributes the success of the franchise to the company’s professionalism in the work place. All staff are office based and the company does not employ people who work from home. Along with outstanding marketing, organisational and operational skills, Home Instead provides superior training programmes and know-how which keep its franchisees ahead of the game every step of the way.

Home Instead Senior Care was the first company of its kind to be officially approved to provide home care services to the HSE. Part of this approval required companies to have the relevant security checks in place for caregivers, as well as outstanding training and on-going monitoring of caregivers. Home Instead already had these procedures in place. The contract covers most parts of Leinster and is expected to expand to cover the rest of the country within the next two years.

Services

Home Instead Senior Care provides non-medical personal care and home-care services to the elderly in the comfort of their own homes. The company markets its services through hospitals, GPs and the HSE, and uses family brochures to provide clients with information on its range of services. Once people get to know about Home Instead, there is a steady stream of enquiries from families. The company sends a team to visit each potential client, to assess their needs and get the kind of information that will enable them to match the client with a suitable caregiver. Its proprietary software and database allow Home Instead to identify the caregiver who will be most compatible with each and every client.

The average age of a typical Home Instead client is 85 years. “Our focus is on the elderly”, states Ed Murphy, “with 96% of our clients being over the age of 75. We provide assistance and support in the home for older people who still want freedom and independence. We help them do it!” he smiles. The company also offers services for younger people suffering from conditions such as early dementia and Alzheimer’s disease.

Employment

Home Instead Senior Care currently employs over 50 people in its network of franchised offices around the country. These offices draw on 700 caregivers to provide the services to the elderly. Twenty per cent of these caregivers are employed full-time. The company significantly increased its number of caregivers in all locations in its second year. Growth plans project that this figure will continue to rise, with the company planning to provide a Home Instead office in all 32 counties over the next three years. The outlook for Home Instead Senior Care is very bright, according to Murphy, with sales projected to reach €30 million and upward in the next five years.

Franchising as a way to start a business

Ed Murphy is enthusiastic about franchising as a way to start a business or expand an existing enterprise. “It’s a great way to go into business! I love it!” He recommends systematic research, suggesting the Irish Franchise Association as a reliable source of information. Prospective franchisees should choose something that they like, and be very selective with master franchises. One of the most important aspects of any franchise, he points out, is its potential for sustained growth.